Leaving is a Privilege

While scrolling through Twitter the other day, I ran across this tweet, which talked about how it’s a privilege to leave a job when you maybe disagree with a decision or a course of action.

Hi friends, just a friendly reminder that not everyone has the privilege to leave a job when they disagree with a decision. There are many reasons that folks stay at a job, and it does not mean they agree with what's happening there. Judging folks for doing so is not ok.

— Sean Griffin (@sgrif) October 26, 2019

Over the past many months, we’ve seen more and more news articles get posted where many of us in tech are learning that companies, whose products we use daily, have made choices to sell their technology to places such as ICE and CBP. These two government agencies have been at the heart of brutal immigration practices, including separating children from parents and running detention centers. As you would hope, when we learned months ago that Chef had a contract with ICE, many folks in technology began to protest. Chef was the first of a few technologies companies found to have contracts with ICE or CBP. Github decided to double down on its stupidity by publically defending renewing its contract with ICE even AFTER employee protests. Finally, Gitlab, not wanting to be left out of the fun, made a change to their internal policies to essentially allow them to take money from anyone who will give it to them.

Every time more news articles came up about these and other companies, some folks on Twitter would make blanket statements that employees at these companies should “just quit” as if it’s an easy there with no complexity what-so-ever.

But as it turns out - there is a lot of complexity involved when you decide you are going to leave your startup. Finding a new job for many folks isn’t something that happens overnight. Even going through that process can be a huge emotional burden for many people. It gets even harder when you have a family to support or other personal or financial needs. What if you had a signing bonus and leaving early could be a big financial hit.

But I think the “stock option” risk is probably the most painful issue that pops up when you move on from a company. The stock options risk only applies to companies that are not yet public, where at a public company, you might have stock grants as part of your compensation package.

So - what happens to the stock options that you’ve vested when you leave a startup? When you leave, you’ll have 90 days to exercise those shares. If you don’t - those shares are gone forever. Assuming your startup was growing - those shares could be “in the money,” which means the value of the stock is higher than your option to buy them.

Let’s take Chef for an example. (Disclaimer, I have never worked with, for, or at Chef, so this is all a hypothetical situation.)

Let’s say you join Chef and get an option grant of 100,000 shares, and since you’re early to the company, the strike price is $0.20. Fast forward four years later - your entire grant has vested, and let’s say that the company’s 409A valuation is now $5.00 per share. Congrats - your shares are worth (pre-tax) $500,000 minus the cost to buy them ($0.20 * 100,000 = $20,000).

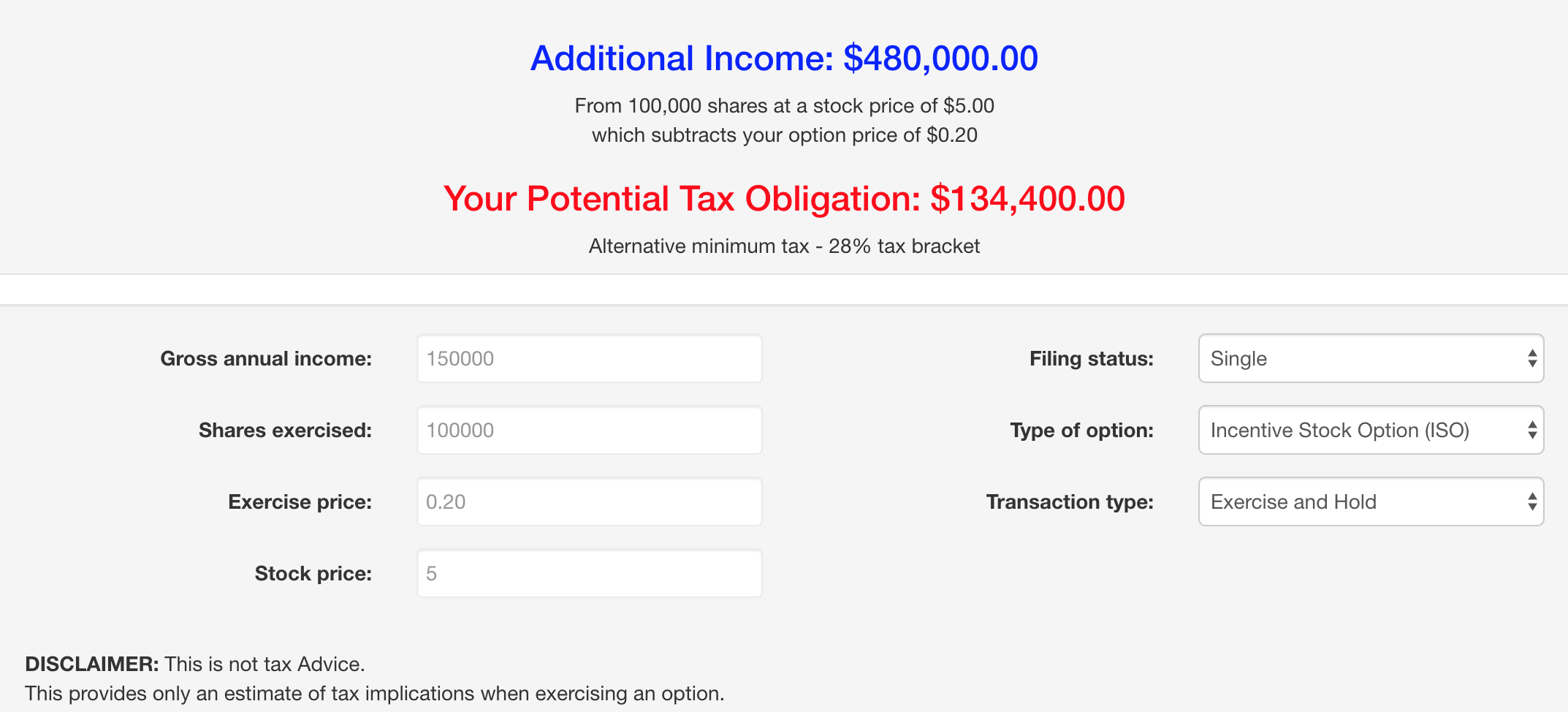

Now - maybe these news revelations come out, and you’ve decided that it’s time to move on. Within 90 days of leaving, you’ll need to have a check for $20,000 ready to go to buy those shares. You could forgo exercising them, but if you did, you’d be leaving nearly half a million dollars on the table. If you didn’t have that money available, you would probably think twice before leaving. But in this example, let’s say that you’ve always been a big saver, and buying those shares isn’t a problem. Well, if you hold those shares into the next calendar year, you’ll need to prepare to pay AMT taxes on them. Yes - you’ll have to pay taxes on stocks you are only “holding,” it’s quite literally the most annoying part of leaving a startup. And if there was a lot of gain in the share price from when you started, this tax hit could be substantial.

So - let’s go back to the example above. I decide to leave because I don’t agree with selling software to ICE, I pay the company $20,000 to exercise my options. Using the calculator at Vestboard, you can see the frightful tax bill that could be coming my way. (Reminder, I’m not an accountant, and if you are dealing with this you should go and speak with one).

Sometimes (not always), the company or board might help you out by buying some of your shares to offset the tax liability but don’t expect them to buy them at the current market rate - which sucks even more as you won’t get the full value you deserve.

You can see now just one example of the complexity that exists when trying to leave a startup, especially one that someone has been working at for a long time. There are TONS of other reasons why its hard to leave a place where you don’t agree with the mission, the vision, or the business they choose to take. Just remember, as Sean said, it’s a privilege to leave a company, don’t judge those that decide to stay.